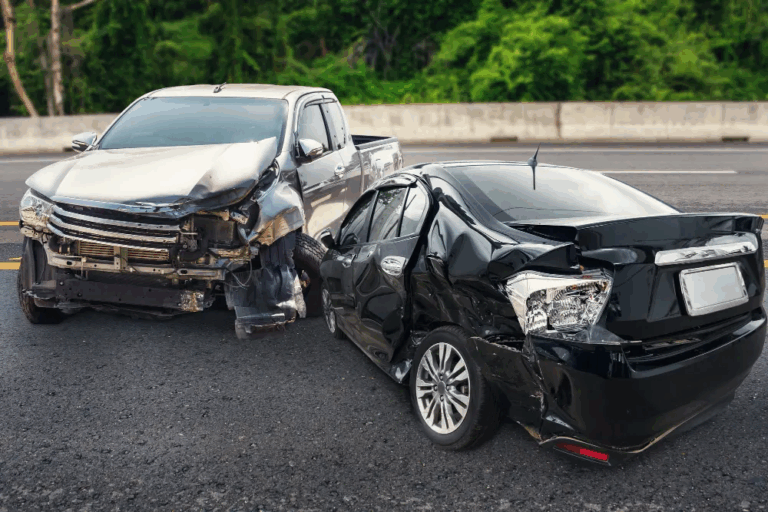

Borrowed Trouble: What Happens When a Friend Crashes Your Car?

When a Favor Turns Into a Headache in Georgia

Letting a friend or family member borrow your car may seem harmless—until they get into an accident. Suddenly, you’re dealing with insurance claims, vehicle repairs, and legal questions you never expected.

In Georgia, car insurance follows the car—not the driver. That means if your friend crashes your car, it’s usually your insurance policy that’s on the hook.

Here’s what you need to know if someone else wrecks your vehicle.

Step 1: Check If the Driver Had Permission

If the driver had explicit or implied permission, your auto insurance will generally cover the damages.

Examples of Permissive Use:

- You lent your friend the car to run an errand

- Your sibling drives your car regularly

Note: If they didn’t have permission (e.g., they took it without asking), the situation gets more complicated, and your insurance may deny the claim.

Step 2: Understand Whose Insurance Pays First

Primary Insurance: Yours

In most cases, your auto policy is primary and will cover:

- Property damage

- Bodily injury liability

- Collision (if you have it)

Secondary Insurance: The Driver’s (Maybe)

If the damages exceed your policy limits, the driver’s own auto insurance (if they have one) might provide secondary coverage.

Important: Insurance companies can dispute liability, especially if the driver wasn’t listed on your policy.

Step 3: Consider Your Policy Details

Your Insurance May Not Cover:

- Drivers excluded from your policy

- Business use of the vehicle (e.g., rideshare driving)

- Accidents outside your coverage area

Always review your policy for exclusions and talk to your insurer to confirm coverage.

Step 4: Prepare for Rate Increases

Even if your friend was at fault, your insurance premium might go up after a claim.

Why? Because your insurer sees the car (and you, the owner) as the risk factor—not just the person driving it.

Step 5: If Someone Is Injured, It Gets More Complex

If the accident caused injuries, your liability coverage may apply. You could be sued as the vehicle owner, especially if:

- The driver was unlicensed

- The car had mechanical problems you knew about

- You allowed someone reckless or intoxicated to drive

Tip: If anyone was injured, contact a personal injury attorney immediately.

What If the Driver Was Not at Fault?

If your friend was hit by another driver, that driver’s insurance should pay for damages. However:

- You may still need to file a claim through your own policy first

- Subrogation may apply, where your insurer seeks reimbursement

An attorney can help ensure fault is correctly assigned and you’re not unfairly penalized.

Can You Sue Your Friend?

Technically, yes—but most people don’t want to sue someone they know. That said:

- If your friend was reckless or impaired, you may need to take legal action to recover damages

- Your insurance company might pursue a claim against them on your behalf

Final Thoughts

When a friend crashes your car, it can strain your finances—and your relationship. But you’re not powerless. Understanding Georgia’s insurance laws and acting quickly can minimize the damage.

Dealing With a Borrowed Car Crash?

At Car Wreck Cowboys, we help Georgia drivers navigate the tricky aftermath of car accidents involving borrowed vehicles. Contact us today for a free consultation, and let us help you protect your rights and your car.